In today’s fast-paced world, managing your personal finances has become more important than ever. With the rise of digital tools, people are increasingly turning to iOS apps to help them take control of their budgeting and financial planning. Whether you’re saving for a major purchase, trying to eliminate debt, or simply looking to track your spending, the right app can make all the difference. But with so many apps available, choosing the right one can be overwhelming. That’s where we come in. In this article, we will explore the best 10 iOS apps for budgeting and finance in 2024, offering detailed insights on what each app offers, its unique features, and how it can help you better manage your money.

As an expert in the finance and budgeting app niche, I’ve spent considerable time analyzing the latest tools available on iOS to provide you with the best options for your personal financial needs. These apps are designed to help users not only stay on top of their day-to-day expenses but also achieve long-term financial goals. Whether you’re a beginner just starting your budgeting journey or a seasoned finance enthusiast, you’ll find tools that suit your lifestyle, help you track spending, optimize savings, and even provide investment advice. This article will break down these apps, giving you everything you need to know to make informed decisions.

The key to successfully managing your finances lies in consistent monitoring, effective goal-setting, and making informed decisions. These apps are tailored to help you achieve these objectives by offering a seamless experience on your iPhone, iPad, or other Apple devices. From syncing bank accounts to providing insights into spending habits and helping you make smarter financial choices, these tools are essential for anyone serious about financial management. Let’s dive in and discover the best budgeting and finance apps that will help you stay on top of your finances in 2024.

1. Mint: The Ultimate Personal Finance App

Mint has long been a leader in the world of budgeting apps, and for good reason. It is an all-in-one personal finance tool that helps users track their spending, set budgets, and view their financial accounts in one place. Mint connects directly to your bank accounts, credit cards, loans, and investment accounts, giving you a complete overview of your financial situation.

Key Features:

- Budget Tracking: Mint automatically categorizes transactions, helping you see where your money is going.

- Bill Payment Reminders: Set up reminders for upcoming bills to avoid late fees.

- Credit Score Monitoring: Track your credit score and see suggestions for improving it.

- Financial Goals: Set savings and investment goals to stay on track.

Why Mint is Great for Budgeting:

- User-Friendly Interface: Mint’s clean design makes it easy to navigate, even for those new to financial apps.

- Free to Use: One of the most popular features is its free access to all essential features.

- Detailed Insights: Mint offers comprehensive spending reports and detailed charts that break down your expenses.

2. YNAB (You Need a Budget): A Proactive Approach to Budgeting

YNAB stands out as an app designed to help you take control of your financial future by following a proactive budgeting system. YNAB is built on the philosophy of giving every dollar a job, which forces users to prioritize their spending and savings.

Key Features:

- Zero-Based Budgeting: Assign every dollar a specific purpose (bill, savings, etc.) for maximum accountability.

- Goal Tracking: Create savings goals for big purchases, emergency funds, or debt repayment.

- Real-Time Syncing: Sync your accounts across all devices to stay up-to-date with your financial situation.

- Educational Resources: YNAB offers a library of educational resources to help users understand the budgeting process.

Why YNAB is Great for Budgeting:

- Focus on Financial Awareness: YNAB’s method encourages users to be proactive rather than reactive with their finances.

- Powerful Reporting: Detailed insights help you analyze spending trends and identify areas to cut back.

- Customizable Categories: Tailor categories and goals to fit your personal financial situation.

3. PocketGuard: Simple Budgeting with Cash Flow Focus

If you’re looking for an easy-to-use app that helps you stay within your limits, PocketGuard is an excellent option. Its simplicity lies in the fact that it focuses on one thing: ensuring you don’t spend more than you have. The app links to your bank accounts and shows how much disposable income you have after bills and savings.

Key Features:

- In My Pocket: See how much disposable income you have left after your bills, goals, and savings are accounted for.

- Automatic Categorization: PocketGuard automatically categorizes your spending, making it easy to track where your money is going.

- Bill Tracking: Stay on top of upcoming bills and avoid late fees.

- Goals and Subscriptions: Set up recurring goals and monitor subscription services that might be draining your funds.

Why PocketGuard is Great for Budgeting:

- Simplicity: PocketGuard’s straightforward approach makes it easy for beginners to grasp.

- Effective Cash Flow Management: PocketGuard ensures you never overspend by showing you exactly how much you can afford.

- Smart Insights: The app provides smart insights to help you optimize your spending and savings.

4. GoodBudget: Envelope Budgeting on Your Phone

GoodBudget is a digital envelope budgeting system that allows users to divide their money into different “envelopes” for various spending categories. This app is perfect for those who prefer a more traditional approach to budgeting but with the convenience of modern technology.

Key Features:

- Envelope Budgeting System: Allocate a set amount of money to each envelope for specific spending categories.

- Sync Across Devices: Sync your budget across multiple devices, making it easy to manage finances with a partner or family member.

- Debt Tracking: Keep track of your debt repayment progress and plan your strategy.

- Customizable Categories: Create and customize categories to fit your lifestyle.

Why GoodBudget is Great for Budgeting:

- Tangible System: The envelope method provides a hands-on approach to managing money.

- Flexible and Customizable: GoodBudget offers flexibility in terms of categories and budgeting goals.

- No Bank Sync Required: If you’re not comfortable linking your bank account, GoodBudget allows manual entry of transactions.

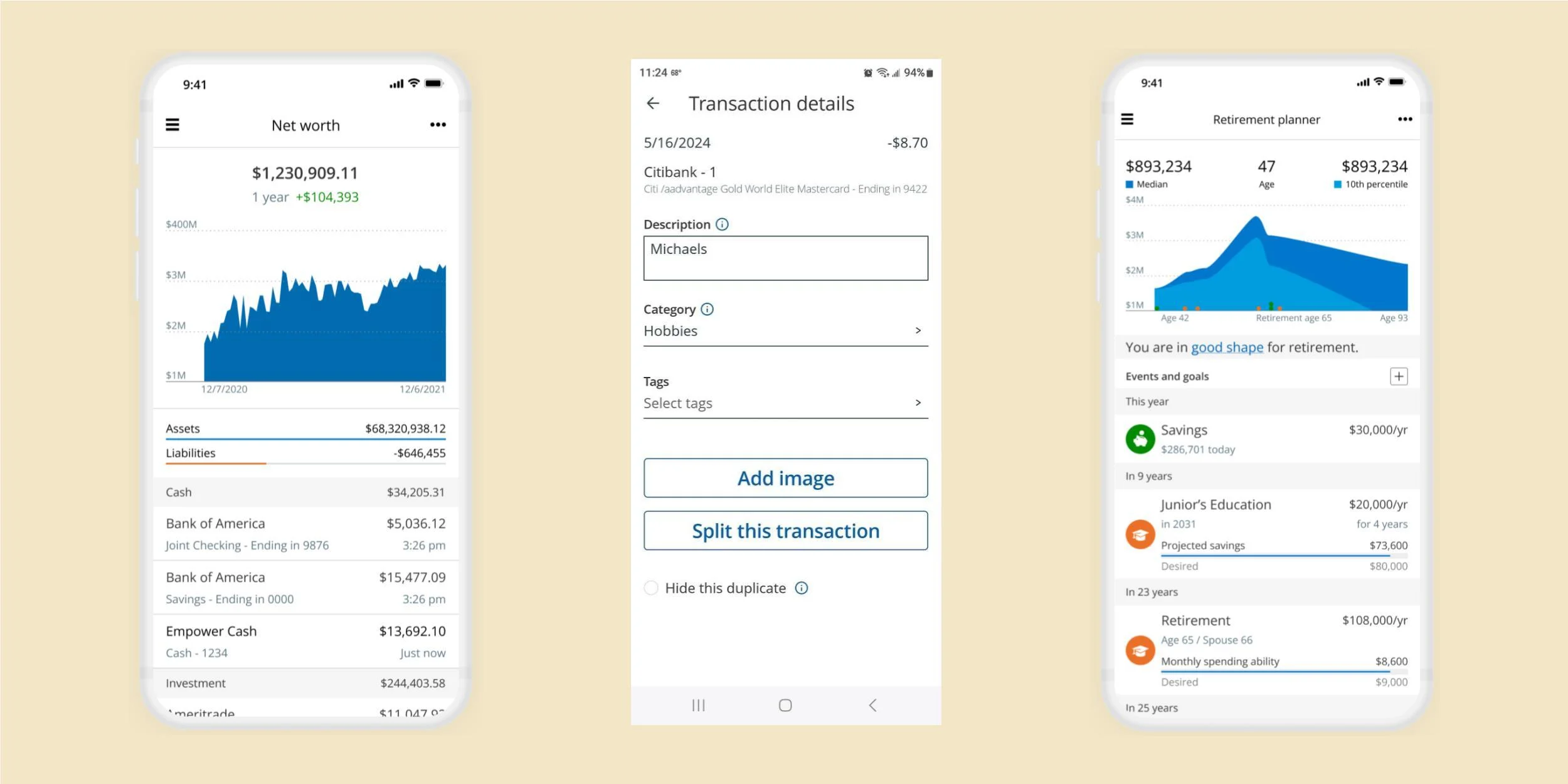

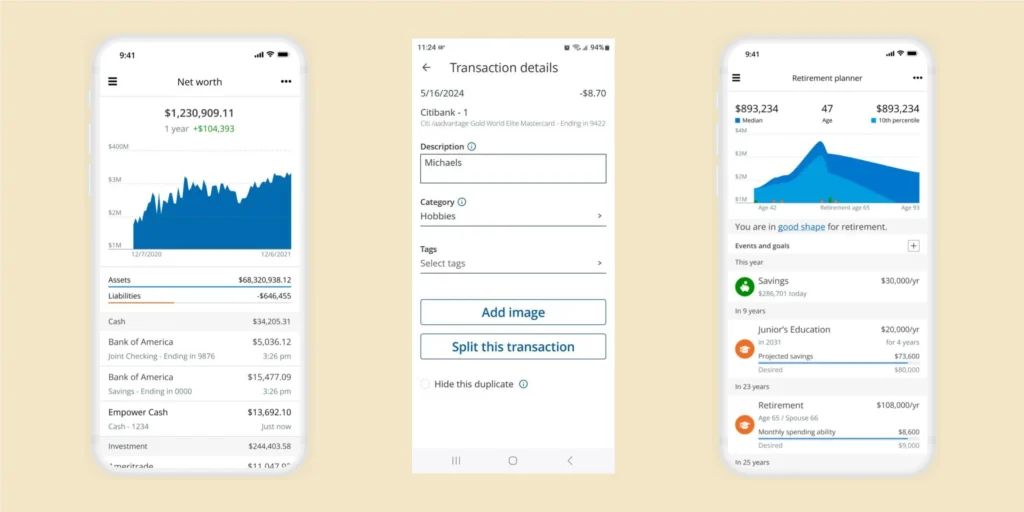

5. Personal Capital: Tracking Investments and Spending

Personal Capital is an app designed for individuals who want to track both their spending and investments in one place. It’s ideal for those who want a deeper dive into their overall financial picture, particularly when it comes to investments.

Key Features:

- Investment Tracker: Monitor your investment accounts, portfolio performance, and asset allocation.

- Net Worth Calculation: View a complete breakdown of your net worth, including investments, assets, and liabilities.

- Expense Tracking: Track your day-to-day expenses and see where your money is going.

- Retirement Planner: Plan for retirement by tracking your savings and providing insights into how much you’ll need.

Why Personal Capital is Great for Budgeting:

- Comprehensive Financial Overview: Personal Capital provides an all-in-one financial dashboard that covers spending, saving, and investing.

- Ideal for Investors: If you have a focus on building wealth, Personal Capital’s investment tools are invaluable.

- Goal-Oriented: Personal Capital helps users create long-term financial goals, whether it’s saving for retirement or purchasing a home.

6. EveryDollar: Budgeting Made Easy with Dave Ramsey’s Method

EveryDollar is a budgeting app that follows the principles set out by financial expert Dave Ramsey. It’s designed for those who want to implement a zero-based budgeting approach and make the most of their income.

Key Features:

- Zero-Based Budgeting: Like YNAB, EveryDollar operates on the zero-based budgeting principle, helping you give every dollar a specific job.

- Bank Syncing: Sync your bank accounts to easily track and categorize your spending.

- Debt Snowball Tracker: EveryDollar provides a tool for tracking debt repayment using the debt snowball method.

- Financial Tools: Access various financial calculators to plan your budget, savings, and debt.

Why EveryDollar is Great for Budgeting:

- Easy to Use: The user-friendly interface makes it easy to set up and manage budgets.

- Debt Reduction Focus: EveryDollar is particularly beneficial for those focused on becoming debt-free.

- Proven Method: Dave Ramsey’s zero-based budgeting method has helped millions manage their finances effectively.

7. Clarity Money: Personal Finance with AI Insights

Clarity Money uses AI to provide users with personalized recommendations and insights on managing their finances. It offers a range of tools to help users track their spending, reduce unnecessary expenses, and find ways to save money.

Key Features:

- AI-Powered Insights: Clarity Money uses artificial intelligence to analyze your spending habits and provide recommendations on how to save.

- Subscription Management: The app helps you manage subscriptions and cancel ones that are no longer needed.

- Credit Score Monitoring: Keep an eye on your credit score and receive alerts if anything changes.

- Cash Flow Tracking: View your income and expenses in real-time.

Why Clarity Money is Great for Budgeting:

- AI-Powered Analysis: Clarity Money’s AI features provide valuable, data-driven insights.

- Subscription Management: The app’s ability to track and manage subscriptions helps users reduce unnecessary spending.

- Comprehensive Overview: Clarity Money offers a 360-degree view of your financial situation.

8. Zeta: Budgeting for Couples and Families

Zeta is perfect for couples or families who want to manage their finances together. It allows you to link your bank accounts and track shared expenses, making it easier to plan budgets and work toward common financial goals.

Key Features

:

- Shared Accounts: Link joint accounts to track shared expenses and monitor financial progress.

- Expense Splitting: Easily split expenses between multiple people.

- Goals and Saving: Set and track financial goals as a team.

- Financial Planning: Use tools to plan for big expenses, like vacations or home purchases.

Why Zeta is Great for Budgeting:

- Collaborative Approach: Zeta’s shared accounts feature helps couples manage their finances together.

- User-Friendly: The app’s clean interface makes it easy for couples to track expenses and goals.

- Comprehensive Financial Planning: Zeta’s financial planning tools help couples stay on track for major milestones.

9. Tiller Money: Automated Spreadsheet Budgeting

Tiller Money is for users who prefer working with spreadsheets but want to automate the process. It syncs with your bank accounts and categorizes your spending, giving you complete control over your budget in a Google Sheets or Excel format.

Key Features:

- Automated Transactions: Sync your bank accounts and automatically import transactions into your spreadsheets.

- Customizable Templates: Use pre-built templates or create your own to track spending, savings, and more.

- Real-Time Syncing: Keep your budget up-to-date with real-time syncing.

- Detailed Reporting: Analyze spending trends with detailed reports and charts.

Why Tiller Money is Great for Budgeting:

- Full Control Over Budget: Tiller Money gives you the flexibility of spreadsheets while automating the most time-consuming parts.

- Customizable: Users can design their budget exactly the way they want.

- Advanced Features: Ideal for users who want more advanced features than typical budgeting apps.

10. Simple: A Bank and Budgeting App in One

Simple combines banking and budgeting into one easy-to-use app. It offers a mobile-first approach to financial management, allowing you to manage your spending, saving, and even investing from one platform.

Key Features:

- Goals and Savings: Set savings goals and automate transfers to help you stay on track.

- Expense Tracking: Categorize and track your spending in real-time.

- Instant Alerts: Receive notifications for bill payments, large purchases, and more.

- Mobile Banking: Simple functions as a full-featured mobile bank with no physical branches.

Why Simple is Great for Budgeting:

- All-in-One Solution: Simple combines budgeting and banking, making it ideal for users who prefer a single app.

- Automated Savings: The app helps users save effortlessly by automating transfers into savings goals.

- User-Friendly: Its intuitive design makes it easy to navigate and manage finances.

Conclusion

In 2024, managing your finances has never been easier thanks to a wide array of iOS apps designed to help users track spending, save for goals, and even invest. Each of the apps listed above offers unique features, allowing you to choose the one that best suits your needs, whether you’re focused on budgeting, debt management, or investing for the future. From Mint’s all-in-one personal finance management to Simple’s seamless banking and budgeting combination, there’s a tool for every financial goal.

As we’ve seen, the best apps for budgeting and finance not only help you track expenses but also provide valuable insights, recommendations, and tools for long-term financial success. Whether you’re new to budgeting or a seasoned financial planner, these apps will help you build better money habits and work towards achieving your financial goals. Take control of your finances today and make the most of the tools available on your iOS device. Happy budgeting!